|

Voiced by Amazon Polly |

The Data Revolution in Financial Services

The BFSI sector faces rising customer expectations, legacy limitations and fast-moving fintech disruptors. The AWS Modern Data Stack enables real-time fraud detection, AI-driven automation, personalized advice and seamless compliance- shifting banks from monolithic systems to agile, cloud-native, AI-powered platforms for survival and competitive advantage.

Start Learning In-Demand Tech Skills with Expert-Led Training

- Industry-Authorized Curriculum

- Expert-led Training

The Modern Data Stack: A Paradigm Shift for BFSI

What Makes It “Modern”?

The Modern Data Stack redefines financial data management with cloud-native scalability, modular tools, real-time insights, AI/ML integration and self-service analytics, enabling agile, intelligent and innovative operations in the BFSI sector.

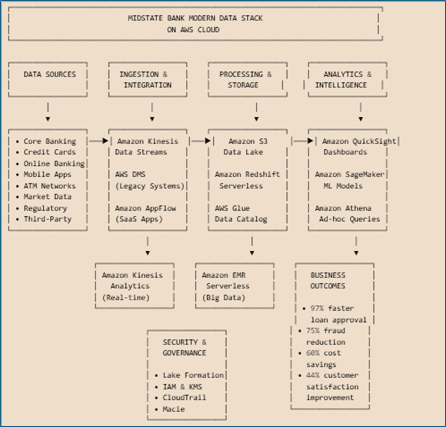

Reference High-Level Architecture:

AWS-based architecture for secure banking data integration and analytics.

Core Features: The Building Blocks of Financial Data Excellence

- Unified Data Ingestion & Integration:

Modern finance needs fast, scalable and reliable data flow. AWS services like Kinesis, DMS, AppFlow and Glue unify real-time, batch and API-based ingestion with automated schema handling and validation.

Why It Matters for BFSI: Banks manage data from hundreds of sources. A unified ingestion stack handles any data type or speed, ensuring accuracy, agility and compliance.

- Scalable Data Lake & Warehouse Architecture:

Modern financial workloads need a scalable and secure architecture. AWS S3 Data Lakes, Redshift and Lake Formation provide petabyte-scale storage, automation, ACID integrity and fine-grained access control across all data formats.

Why It Matters for BFSI: Financial data is diverse. This architecture handles every type while meeting strict security and compliance needs.

- Real-Time Processing & Analytics:

Real-time insights are essential in financial services. AWS tools like Kinesis, MSK, EMR, Glue and Lambda enable sub-second fraud detection, live risk analysis and instant regulatory monitoring.

Together, they create an intelligent, real-time analytics framework that reacts quickly to market and customer needs.

Why It Matters for BFSI: Timing is critical. Real-time processing can prevent fraud, reduce losses and improve customer retention.

- AI/ML-Powered Intelligence:

AI and ML are transforming financial decisions and customer engagement. AWS services like SageMaker, Bedrock, Comprehend and Forecast enable automated underwriting, smarter document processing and predictive customer analytics.

NLP enhances service with intelligent, conversational interfaces, driving efficiency and deeper insights.

Why It Matters for BFSI: AI/ML is now essential for competitive advantage and the modern stack makes it scalable and accessible for all financial institutions.

- Advanced Security & Compliance:

Financial data security is non-negotiable. AWS tools like Lake Formation, Macie, CloudTrail and KMS provide strong encryption, tight access control and automated compliance with full audit trails.

Why It Matters for BFSI: The industry is highly regulated, and this stack ensures security and compliance that evolve with changing requirements.

- Self-Service Analytics & Visualization:

Visualization powers data-driven decisions. AWS QuickSight, Athena and OpenSearch enable simple dashboards, NLP queries and embedded analytics, accessible on any device.

Why It Matters for BFSI: Easy, self-service insights let every employee act on data without waiting for IT.

Transformative Use Cases: Real-World Applications:

- Real-Time Fraud Detection & Prevention:

By combining real-time streams, behavioural data and SageMaker-powered ML, financial institutions can detect fraud in sub-seconds and dramatically reduce losses.

- Intelligent Credit Risk Assessment:

Modern ML-driven credit scoring blends bureau, banking, sentiment and economic data to deliver faster, more accurate and explainable lending decisions.

- Personalized Customer Experience:

A 360° view of customer behavior enables real-time personalization, driving higher cross-sell success and improved satisfaction.

Sample Implementation: Digital Bank Transformation

Let me walk you through an example of how a mid-sized regional bank can transform its operations using the Modern Data Stack on AWS.

Challenge: Legacy systems, 47 data silos, slow credit decisions, heavy compliance and 15% churn.

- Phase 1 – Foundation (Months 1-3): Build a secure, scalable data lake with S3, Glue and Lake Formation; ingest data via Kinesis, DMS and AppFlow from core banking, payments, mobile and customer systems.

- Phase 2 – Analytics & ML (Months 4-6): Use Glue ETL and Kinesis Analytics for processing; SageMaker for fraud detection, credit scoring, churn prediction; Redshift, QuickSight and OpenSearch for analytics and insights.

- Phase 3 – Advanced Use Cases (Months 7-12): Enable real-time fraud detection, personalized offers, continuous risk monitoring, AI-driven chatbots, document processing, sentiment analysis and advanced analytics for smarter, strategic decisions.

The Results: What Transformation Can Deliver

Modernizing your financial data stack drives faster loan approvals, higher customer satisfaction, real-time fraud detection and lower processing costs. It boosts revenue through cross-sell and new customers, strengthens risk management and scales efficiently for large data volumes and ML workloads, delivering a strong ROI in just months.

The transformation starts with a single step. The time to take that step is now.

Getting Started: Your Modernization Journey

- Step 1 – Assessment & Strategy (Month 1): Analyze current data architecture, build ROI case, align stakeholders and define roadmap.

- Step 2 – Foundation (Months 2–4): Set up AWS accounts, implement data lake, integrate initial sources and enable basic analytics.

- Step 3 – Advanced Capabilities (Months 5–8): Add real-time processing, develop ML models, deliver advanced insights and enable self-service analytics.

- Step 4 – Scale & Optimise (Months 9–12): Roll out organisation-wide, implement advanced use cases, optimise performance and establish continuous improvement.

The Future is Data-Driven

The financial services industry is undergoing rapid transformation. AWS Modern Data Stack enables real-time fraud detection, AI-driven personalisation and automated compliance, helping BFSI organizations compete and win. The future is data-driven, AI-powered and cloud-native and the time to modernize is now.

Upskill Your Teams with Enterprise-Ready Tech Training Programs

- Team-wide Customizable Programs

- Measurable Business Outcomes

About CloudThat

CloudThat is an award-winning company and the first in India to offer cloud training and consulting services worldwide. As a Microsoft Solutions Partner, AWS Advanced Tier Training Partner, and Google Cloud Platform Partner, CloudThat has empowered over 850,000 professionals through 600+ cloud certifications winning global recognition for its training excellence including 20 MCT Trainers in Microsoft’s Global Top 100 and an impressive 12 awards in the last 8 years. CloudThat specializes in Cloud Migration, Data Platforms, DevOps, IoT, and cutting-edge technologies like Gen AI & AI/ML. It has delivered over 500 consulting projects for 250+ organizations in 30+ countries as it continues to empower professionals and enterprises to thrive in the digital-first world.

WRITTEN BY Muhammad Imran

Muhammad Imran is a seasoned Cloud Technology Expert and Vertical Head for the AWS Data Analytics at CloudThat. With over 11 years of experience in the training industry, he has built a strong reputation for delivering impactful, hands-on learning experiences in cloud computing. As an AWS Authorized Instructor (AAI Champion) and Microsoft Certified Trainer (MCT), he has empowered thousands of professionals and organizations worldwide to adopt and master cloud technologies. He holds multiple certifications across AWS and Azure, particularly in Data Analytics, reflecting his deep technical expertise. Imran specializes in AWS, Azure, and Databricks, providing comprehensive, real-world training that bridges the gap between theory and practice. His engaging delivery style and practical approach have consistently earned high praise from learners and organizations alike. Beyond training, he contributes actively to CloudThat’s consulting division- architecting, implementing, and optimizing data-driven cloud solutions for enterprise clients. He also plays a key role in leading experiential learning and capstone programs, helping clients achieve measurable outcomes through hands-on project-based training. Imran's passion for cloud education, commitment to technical excellence, and dedication to empowering professionals make him a recognized thought leader and trusted advisor in the cloud community.

Login

Login

December 16, 2025

December 16, 2025 PREV

PREV

Comments