|

Voiced by Amazon Polly |

Over the last few years, artificial intelligence has gradually infiltrated enterprise software and now, Copilot is emerging as a game-changer for finance teams. Within the Dynamics 365 Finance ecosystem, Copilot is not just a novelty; it is beginning to transform how financial operations are performed daily. In this blog, I explore how Copilot is influencing financial operations, what it uniquely brings to Dynamics 365 Finance and the key implementation considerations teams should consider.

This isn’t a superficial glance. I aim to balance technical depth (workflow, architecture, controls) with real-world insight so that finance and technical audiences can both see how value is created (and where friction might lie).

Start Learning In-Demand Tech Skills with Expert-Led Training

- Industry-Authorized Curriculum

- Expert-led Training Sessions

Why Finance Needs More Than Automation

Financial operations, such as reconciliations, collections, variance reporting and closing, are islands of work that have historically required significant manual effort. Teams often spend hours reconciling sub-ledgers, chasing down discrepancies or manually drafting reminder emails. Meanwhile, leadership expects real-time insights to support strategic decisions.

Here’s where Copilot starts to shift the paradigm: it doesn’t just automate – it assists contextually, surfaces insights proactively and helps bridge the gap between raw ERP data and human decisions.

Copilot in the Context of Dynamics 365 Finance

To understand the transformative impact of this, it’s helpful to break down where Copilot integrates within the Dynamics 365 Finance environment.

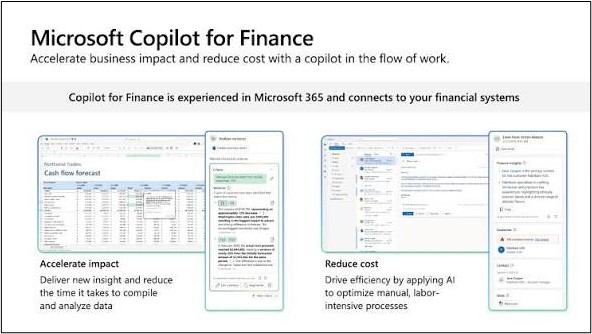

Integration of Microsoft Copilot for Finance within Dynamics 365 Finance to enhance insights and reduce manual effort.

Embedded & Sidecar Modes

In Dynamics Finance and Operations apps, Copilot surfaces in different “modes”:

- App sidecar: a conversational pane beside the user interface, where users type questions or prompts about data or tasks.

- Embedded AI elements: smart summaries or insights injected directly into existing workspace pages (for example, summarizing collections risk in the Collections workspace).

- Across 365 Integration: because Copilot for Finance connects into Microsoft 365 (Excel, Outlook, Teams), users can ask financial queries from Excel or receive context-aware prompts via Outlook.

These integration surfaces make Copilot more than a standalone assistant- it blends into workflows.

Key Capabilities Driving Impact

Within the Dynamics 365 Finance domain, here are core capabilities where Copilot is already influencing change:

- Collections and Receivables Workflows

Copilot can automatically rank overdue accounts by priority, generate draft reminder emails and provide customers’ payment behavior summaries. This speeds up outreach and minimizes manual back-and-forth. - Variance & Exception Detection

Rather than requiring finance analysts to sift through rows of transactions, Copilot can highlight anomalies, flag outliers and propose drill-downs for root cause analysis. It effectively becomes a first-pass filter. - Reconciliation & Period-End Close

Microsoft is embedding agents such as the Account Reconciliation Agent that automate transaction matching and exception-flagging, reducing the time for close activities. - Natural‑Language Query Against ERP Data

Because Copilot is linked to the data model and security roles, users can type ad hoc questions, such as “What’s my overdue AR balance by region?” and receive answers immediately without having to manually construct the report. - Agent Creation (Custom Logic)

Organizations can build tailored Copilot agents using Copilot Studio (or similar tools) for scenarios such as allocation modeling, compliance checks or internal control workflow

These capabilities, when used together, can shift finance teams from reactive operations toward more forward-looking, insight-driven work.

The Value Delivered & Risks to Manage

Value Drivers

- Time savings & throughput: Early pilots (e.g. Microsoft’s internal trials) suggest reconciliation that took an hour or more can shrink to 10 minutes.

- Better decision support: Insights are surfaced faster, helping leadership see variances, risk trends and opportunities earlier.

- Consistency & error mitigation: Copilot enforces consistent logic for matching, highlighting or summarizing, reducing human oversight gaps.

- Scalability: As volume grows, finance teams won’t be linearly burdened as Copilot agents scale with data.

- User adoption: Because Copilot lives inside familiar tools (Excel, Dynamics, Outlook), the barrier to adoption is lower.

Risks and Challenges

- Data security & access constraints: Because Copilot needs access to transactional data, role-based security and sensitivity of financial data must be tightly managed.

- Transparency & auditability: Users must see how Copilot arrives at its suggestions; opaque “black-box” logic is a danger in audit-sensitive contexts.

- Model drift & context gaps: Over time, business rules change; agents need maintenance, so suggestions remain reliable.

- Change management: Some finance professionals may resist depending on AI. Training and gradual rollout are key.

- Cost/licensing complexity: Enabling the full spectrum of Copilot features (e.g. custom agents) may incur additional licensing or infrastructure costs.

Best Practices for Adoption

To maximize success, here are recommended practices:

- Start with high-impact, low-risk use cases like collections or variance detection before expanding to mission-critical close processes.

- Enable audit trails & “explainability”: always show the data sources and logic behind Copilot’s suggestions.

- Secure role-based access: restrict what data Copilot can pull or act upon to minimize unintended exposure.

- Iterative feedback loops: collect user feedback actively to refine prompts, agents and thresholds over time.

- Governance & monitoring: have a small center of excellence overseeing model drift, versioning and performance metrics.

- Hybrid model: allow human override or review before final action so Copilot aids, not replaces, judgment.

Sample Scenario: End-to-end Collections Flow

Here’s how a real-world collections case might evolve using Copilot.

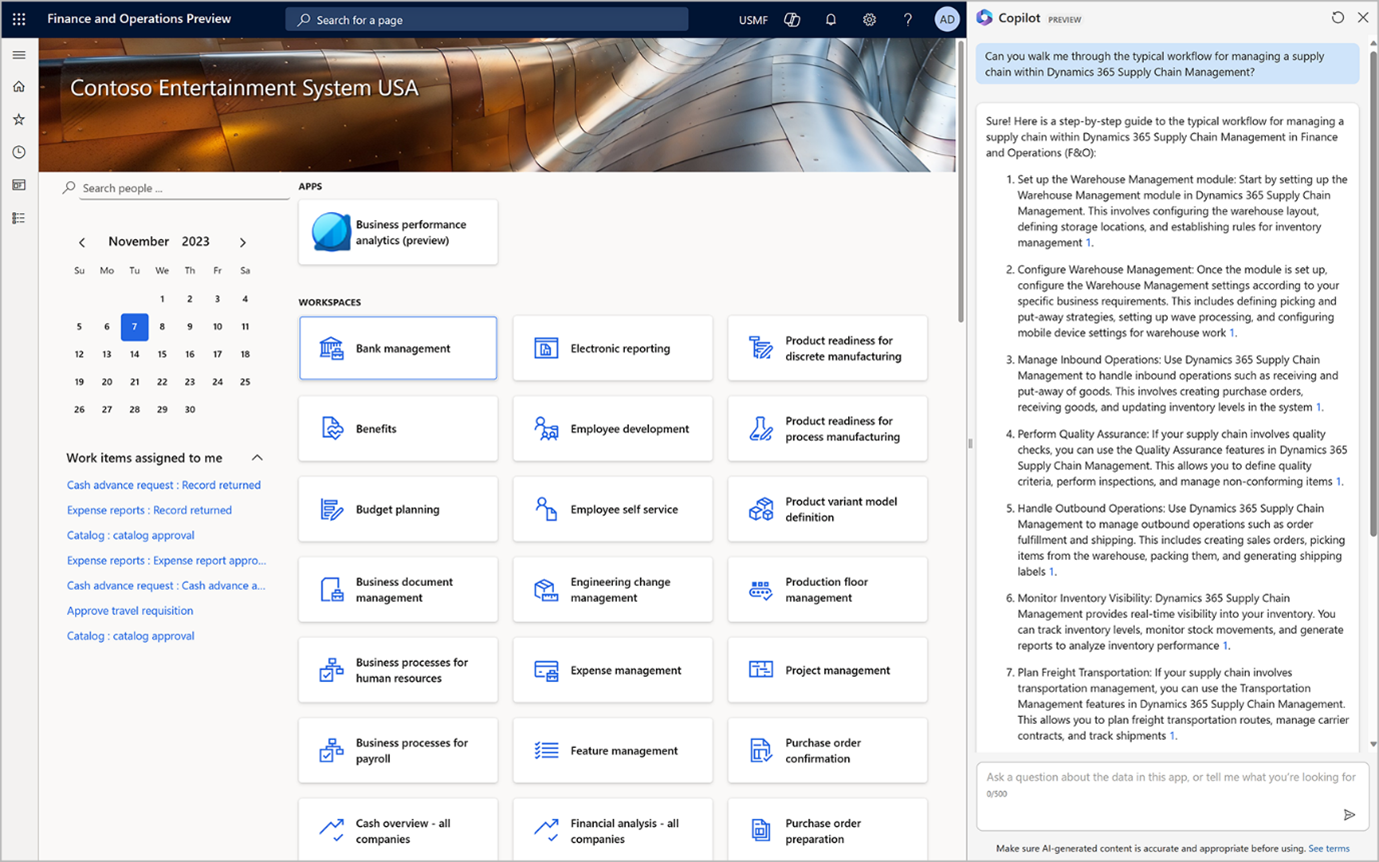

- Prompt initiation

A collections coordinator asks: “Which customers are most overdue and need to have reminder drafts.” - Copilot suggests a priority list

It ranks accounts by aging, payment risk, and historical behavior, and surfaces the top 5 that need attention. - Draft emails

For each customer, Copilot drafts a payment reminder or negotiation proposal, referencing prior invoices and payment history. - Human review & dispatch

The coordinator reviews and edits drafts, then sends them from Outlook (with tracking back to ERP). - Response summarization

Incoming replies or updates are summarized by Copilot and written back as notes to the ERP system. - Monitoring & escalation

If no response is received, Copilot can flag for escalation or auto-generate follow-up prompts.

Copilot in Dynamics 365 Finance automates workflows with conversational AI.

This workflow compresses what used to take hours over multiple systems into a more streamlined, conversational flow.

For instance, companies like CloudThat offer hands-on training programs and labs tailored for finance professionals, functional consultants and solution architects looking to deepen their expertise in Dynamics 365 Finance. Courses such as MB-310: Microsoft Dynamics 365 Finance provide guided practice in configuring and managing core financial components, including the general ledger, accounts payable, accounts receivable, budgeting and fixed assets, while also introducing participants to modern AI capabilities like Microsoft Copilot for Finance.

Through practical labs and scenario-based exercises, learners gain experience in:

- Streamlining financial operations using automation and AI-driven insights within Dynamics 365 Finance.

- Managing period-end close, reconciliations and collections workflows enhanced by Copilot integration.

- Applying role-based security, data governance and compliance controls is essential for enterprise-grade financial systems.

- Connecting Dynamics 365 Finance with Microsoft 365 tools (Excel, Outlook, Teams) for a unified, intelligent finance experience.

The Future of Finance Automation

Copilot is reshaping financial operations in Dynamics 365 Finance by blending AI-driven assistance, embedded workflows, and conversational data access. It doesn’t eliminate human judgment but augments it, freeing finance professionals to focus more on strategy and less on rote tasks.

Upskill Your Teams with Enterprise-Ready Tech Training Programs

- Team-wide Customizable Programs

- Measurable Business Outcomes

About CloudThat

CloudThat is an award-winning company and the first in India to offer cloud training and consulting services worldwide. As a Microsoft Solutions Partner, AWS Advanced Tier Training Partner, and Google Cloud Platform Partner, CloudThat has empowered over 850,000 professionals through 600+ cloud certifications winning global recognition for its training excellence including 20 MCT Trainers in Microsoft’s Global Top 100 and an impressive 12 awards in the last 8 years. CloudThat specializes in Cloud Migration, Data Platforms, DevOps, IoT, and cutting-edge technologies like Gen AI & AI/ML. It has delivered over 500 consulting projects for 250+ organizations in 30+ countries as it continues to empower professionals and enterprises to thrive in the digital-first world.

WRITTEN BY Anoop H A

Anoop H A is a Microsoft Certified Trainer (MCT) at CloudThat with over 9+ years of experience in the training industry. He has delivered 600+ sessions and trained more than 4,000 professionals across various domains. Anoop specializes in Microsoft Fabric, Power BI, Azure AI, Dynamics 365, Tableau, and Advanced Excel with Copilot, offering impactful training to clients including Microsoft and other leading corporates. Known for his passionate and learner-centric approach, he stays aligned with the latest tech trends and has conducted numerous seminars and webinars, both online and offline. In recognition of his excellence, he has received the prestigious MCT Quality Award and was named among the Top 100 MCTs globally for 2024–2025.

Login

Login

November 12, 2025

November 12, 2025 PREV

PREV

Comments